Nine months ago I posted an update on how Wayward was selling in the market and compared it to a similar release period for Skullkickers, my breakout creator-owned series that launched in 2010. I wanted to get this update pulled together sooner, but things have been busy, in a very good way. Lots of great new work-for-hire projects on tap along with a small break to clear my head. But now that the summer is well underway I’ve had a bit of time to dig back into the numbers and, as always, I think it’s interesting to look at how it’s developing.

The comic market is jam-packed with product. There’s a cornucopia of choices for readers every week, with more titles fighting for shelf space and a sense that grabbing market share requires constant reboots, renumbering, and controversy in order to move the needle.

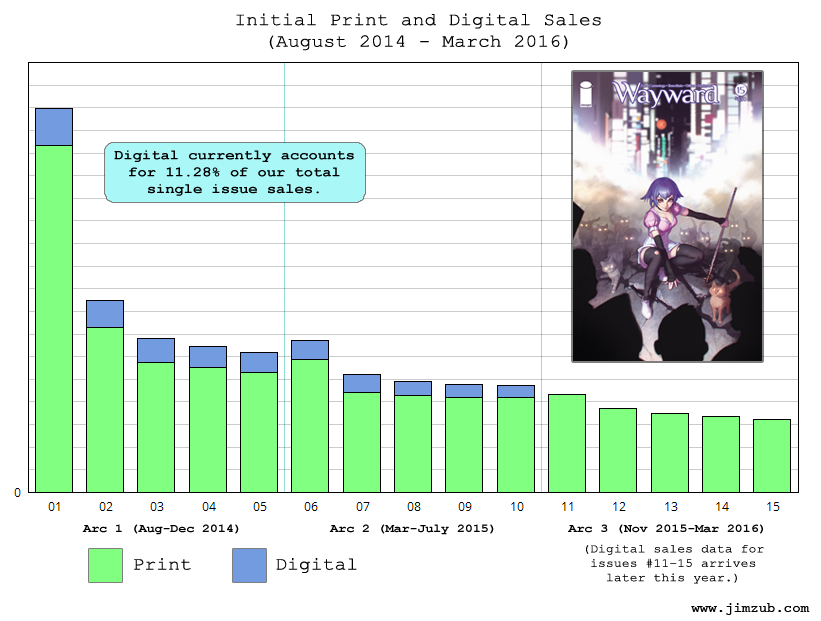

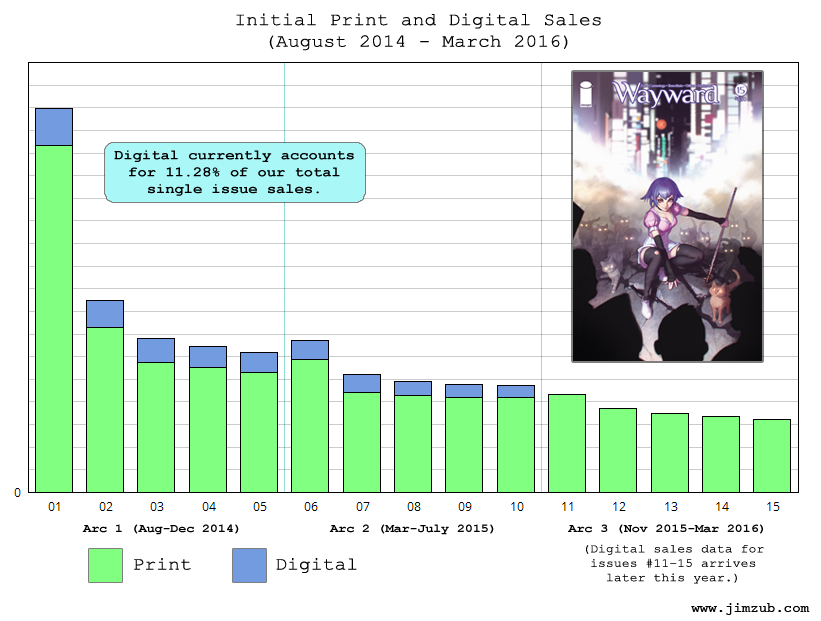

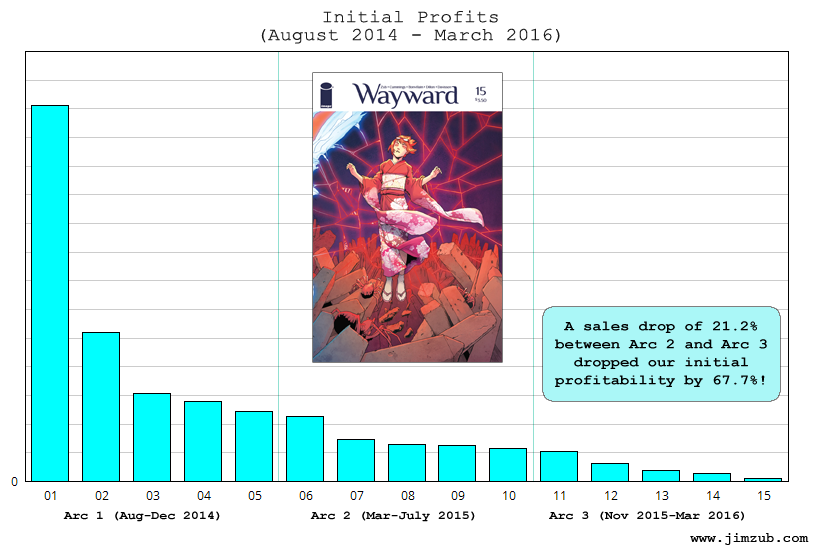

Keeping a creator-owned title consistent and making it successful without the marketing muscle or global movie icon status Marvel or DC have is tough. Wayward launched quite strongly and by the end of our second story arc it looked like we’d found a relatively stable sales level. Let’s see how that’s continued with arc 3:

Wayward #11-15 follows what a lot of industry people would call ‘standard market attrition’. The start of each story arc sees a small boost and then the numbers continue to settle a bit lower each month after that. You’ll see a similar curve for a lot of superhero titles, which is why there’s a tendency to hit that ‘relaunch’ button more and more frequently. Raising awareness on a title and doing a round of press is expected for a new #1, while it’s much-much harder for readers, retailers, and reviewers to take notice of a #11 or a #16.

Still, that bar graph doesn’t look too bad. It’s a graceful easing after issue 1. What does that mean for our single issue profitability?

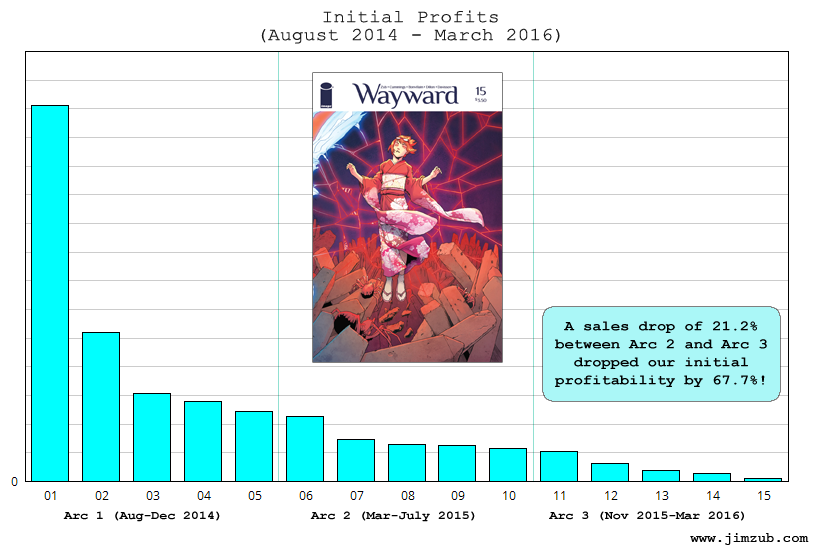

Yikes. Okay, that definitely doesn’t look good. In Wayward arc 3 we started skimming along the threshold where printing and distribution costs start to really eat into profitability. As I’ve talked about before, the cost of creating a product like a comic varies depending on your ‘price per unit’. The more you’re able to print (and sell), the cheaper each one costs, vastly improving your profitability. Once you dip below a certain key threshold, that balance between production cost and profitability starts to work against you. Even though our sales in arc 3 only dropped 21.2%, the profitability on those single issues dropped 67.7% because we fell below that ideal balance.

So, you look at that and it seems pretty obvious – Wayward’s days must be limited. We probably shouldn’t even be producing a fourth story arc because we’re going to drop right off that chart into unprofitability. At best we should wrap our story up by issue 20 and call it a day, right?

Wrong.

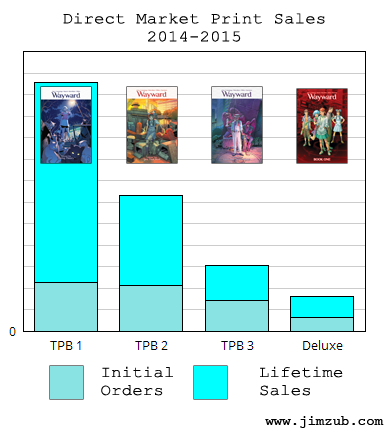

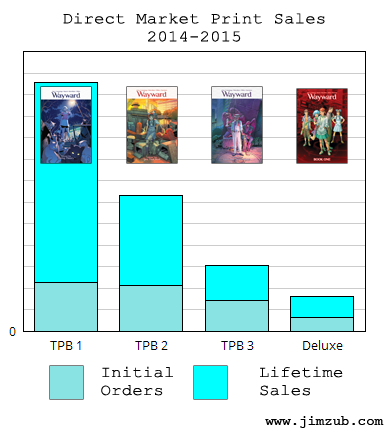

Let’s look at our trade paperback sales and you’ll see why.

Since the first Wayward trade paperback launched in March 2015, we’ve seen explosive growth in our collection sales. Unlike single issue sales where initial orders define the health of a series, trade paperback sales have the potential to be ‘long tail’; They continue to grow rather than shrink. In fact, in Q3-Q4 2015 we sold more trade paperbacks than we did at launch. Wayward is consistently picking up new readers and quite a few of them are moving on to buy Volume 2 and 3 or our Deluxe Edition hardcover (which includes volume 1 + 2 + 80 pages of back matter + poster all in one spiffy over-sized package).

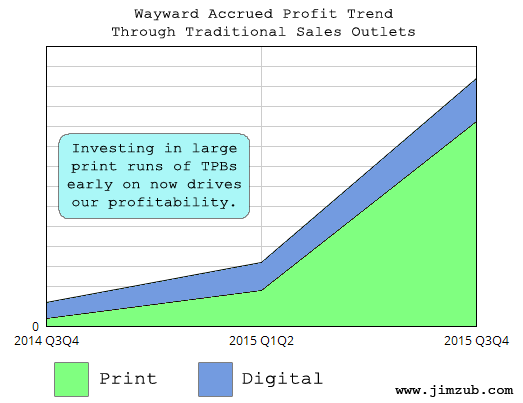

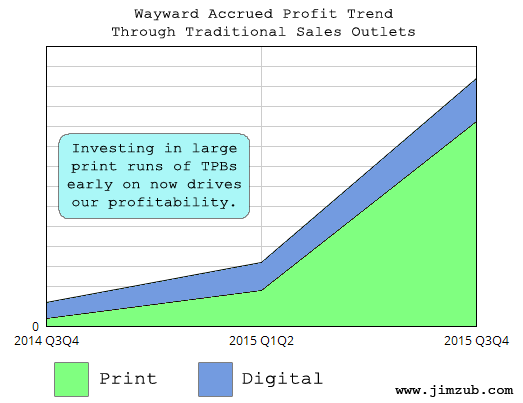

Let’s compare cost versus sales:

In late 2014 Image invested in a large print run of Wayward Vol. 1, confident the series could continue to sell as long as we were consistent with our release schedule. With each subsequent sales period you can see how that’s working: the collection back stock continues to move, making each six month block more profitable than the last. By Q3-Q4 2015 we’re making more than double what’s been spent on printing, shipping, and storage while digital sales continue to grow, increasing our overall readership.

Skullkickers had six month periods where the collections made more than was being spent on printing and distribution, but early expenditures dug a deep hole we had trouble getting out of and the overall margins were much thinner. We finished the series, but barely broke even when it was all said and done.

If all you saw was analysis of monthly single issue sales, Wayward would look like a middle-of-the-pack Image title with unremarkable numbers. It has a small but dedicated readership in single issue format (and they mean a lot to us), but the bigger story is the success it’s seeing in collection sales.

Wayward does really well in comic shops, book stores, libraries, online retailers, and conventions in a collected format where people get a chunk of story all at once and then anticipate what comes next. Our ‘Buffy in Japan’ sales pitch mixed with high quality art/story, good word of mouth, YALSA recognition, and our ability to balance on a shaky tightrope between American comics and manga is working for us.

I would love for our single issue sales to be higher (and I’m hoping more of our collection readers will get impatient and subscribe at their local comic shops) but right now our trade paperback sales are strong enough that we can continue to push forward. Steven can continue to make Wayward his full time job, Tamra, Marshall, Zack (and now Ann who is helping with Irish lore research), and our alt cover artists all get paid, and I get to keep building this supernatural adventure series chapter by chapter, arc by arc.

As I’ve mentioned many times before, tracking the life or death of one creator-owned comic series isn’t an accurate barometer for the industry as a whole, but I do think Wayward is following several trends worth noting:

The Long Tail:The importance of trade paperback collections for the long term viability of a series is undeniable and I think that trend is going to continue as the market keeps expanding beyond traditional comic shops. Image has done a masterful job at leveraging the visibility of The Walking Dead, Saga, Sex Criminals, The Wicked + The Divine and many other hit series to build trust in the book and library market for their collections. Every Image title has benefited from that rising tide.

Digital Is Growth: As many people have noted, digital isn’t killing the traditional print market. Yes, there are people switching to digital, but the majority of digital comic readers seem to be “additive”, new or returning readers supporting work rather than pirating it. Digital may only account for 11.28% of our sales, but profit-wise it’s a valuable addition that helps keep our series running.

Single Issues Matter, But They’re Not The Whole Story: Single issue sales still have a place in this market. Serializing stories over months builds an audience, builds market awareness, and gives readers more options even if trade paperbacks are the go-to choice for more and more fans. That said, I think the emphasis placed on single issue sales to determine success/failure is short-sighted and damaging. Right now it feels like the Diamond 300 chart and the New York Times Best Seller List for Graphic Novels are the only two metrics people follow and neither one covers a broad enough picture of sales and growth. The ‘single issue success’ mentality leads to the kind of boom-or-bust speculation and variant cover glut that has destabilized the market before and could do so again.

The Middle of the Pack Is Important: The prose publishing world has slowly eaten away at the idea of “mid-list authors” and I think comics should be careful not to slip into a similar mindset. Comic sales continue to grow in a market where many other categories struggle and the best way to keep those gains from being clawed back is by continuing to build out the market with variety rather than sinking all development into a narrow field of “hit-makers” or Hail Mary-style events/ controversies/ reboots/ renumberings.

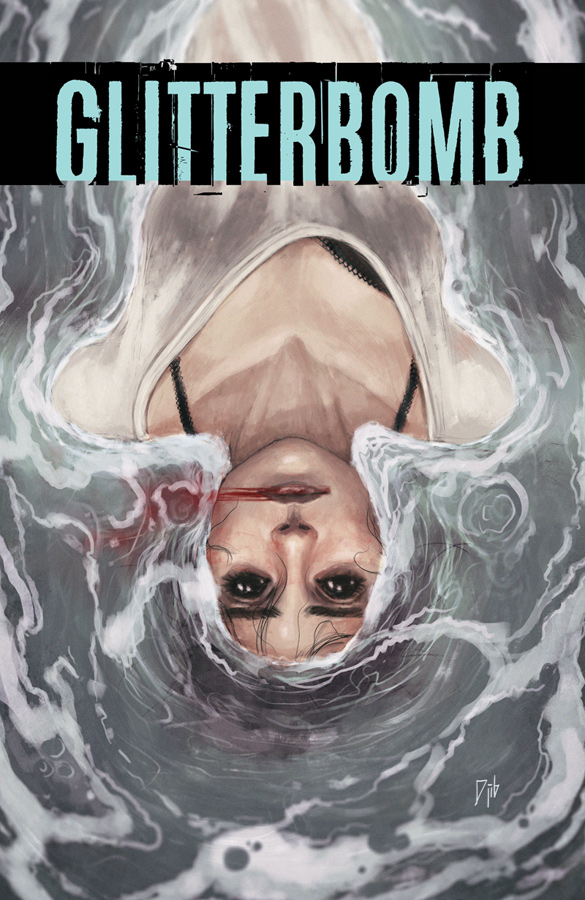

Wayward #16, beginning our fourth story arc, arrives in late September. Glitterbomb #1, my new Hollywood horror series, launches earlier that same month. I’m hopeful for my own personal growth and the continued strength of the industry as a whole. Tell people about the books you feel are worth investing in and support the kind of industry you want to see now and into the future.

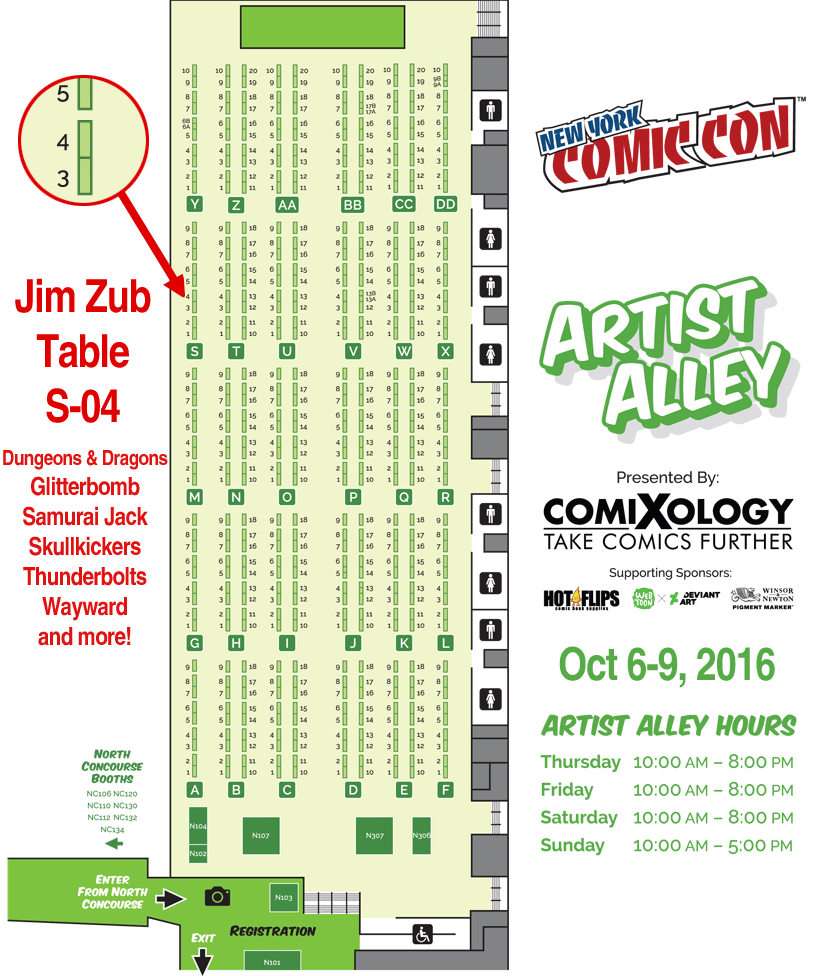

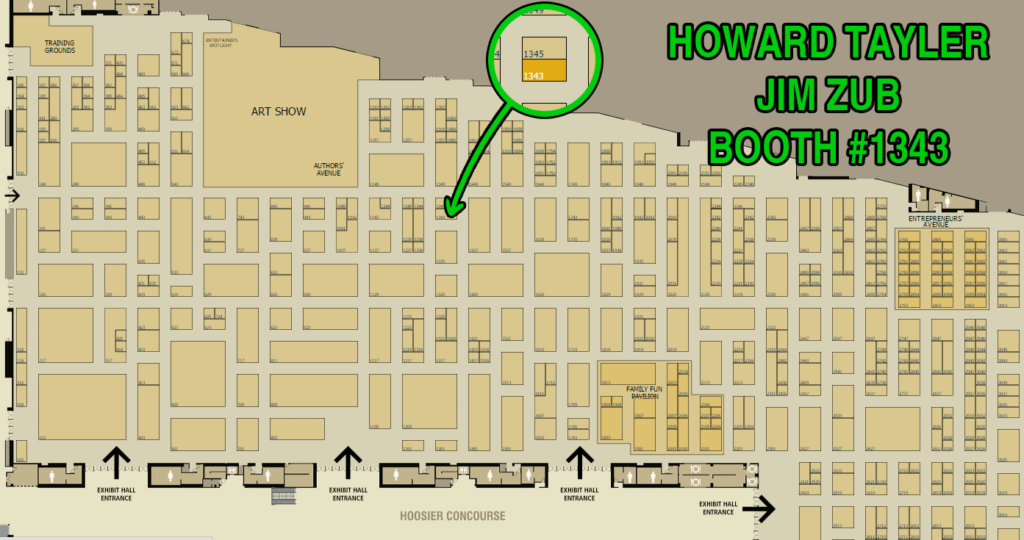

If you found this post interesting, feel free to let me know here (or on Twitter), share the post with your friends and consider buying some of my comics, donating to my Patreon, or buying comics from me in person if you see me at a convention.

Zub on Amazon

Zub on Amazon Zub on Instagram

Zub on Instagram Zub on Twitter

Zub on Twitter