Seven months ago I put together a pretty extensive post all about how long term sales were going on Skullkickers. I wanted to give people an understanding of the economics of what I’m doing without revealing the exact dollar amount figures involved (that information is between Image Comics and the creative team).

Since then I’ve received a new accounting accrual from Image and also had a chance to dig deeper into the numbers and understand how to chart them more accurately. If I were to print the accounting statement out, it would be more than a dozen pages of columns filled with numbers, so there’s quite a bit of data there to parse out. There are a dizzying amount of categories, debts and credits applied based on sales, printing, shipping, storage and book orders for conventions. Thankfully each section is broken down with a current loss/gain total and those totals are carried over from previous accruals.

So, without further ado, here’s an updated look at where we’re at and some of my thoughts.

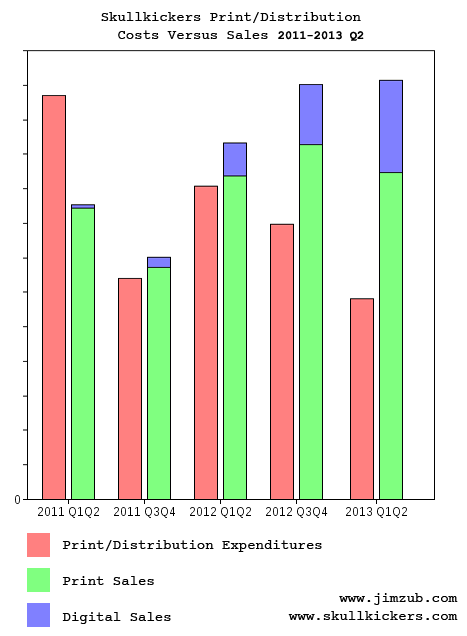

Here’s how Skullkickers has performed from our launch back in 2010 through to the first half of 2013:

2011 Q1-Q2: We dug into the red aggressively overprinting the first trade paperback to keep it in stock and profits gained from the issues, trade and minuscule digital sales didn’t cover the difference that early into its sales cycle. All in all, we dug down 27% more than we made in the first half of 2011.

For most creators that would’ve been the end of it and that’s totally reasonable. Even with Image covering costs so we didn’t have to spend our own money to print or distribute, the complete lack of profits for 6 months would have sealed the series’ fate. Thankfully, Edwin, Misty and I all have day job income and stuck it out for the long haul.

2011 Q3-Q4: In the second half of 2011 we turned things around, actually making 8% more than we spent for that half of the year. It wasn’t enough to pay back the debt incurred from the first half of 2011, but it showed some promise. Most new businesses have to go into debt to start something new. The fact that within 6 months we were able to reverse that trend and start paying it back was encouraging.

2012 Q1-Q2: Printing a hardcover deluxe collection of 1 & 2 together cost a lot, but we were still able to stay narrowly ahead. Digital made a huge sales jump here compared to 2011 and that corresponds with us starting to serialize Skullkickers online for free. I don’t think that’s a coincidence. Our web visibility exploded and digital comic sales followed. Digital wasn’t a large percentage of total sales, but helped keep our head above water.

2012 Q3-Q4: Now we’re starting to see the benefit of the back catalogue and digital sales as our overall profitability goes up on the series. It wasn’t enough to pay off the original debt incurred in 2011 but the overall trend was a positive one.

2013 Q1-Q2: In my previous post I mentioned that we had the potential to continue to sell our backlist of material and build up greater digital sales. That’s exactly what happened in a big way. Our earlier trades have kept selling and we’ve expanded our reach with more digital sales while not incurring as many new printing costs. Digital sales accounted for 22% of our profitability, helping us hit a new high.

With new trades being printed in the future and the second Treasure Trove deluxe volume being released we probably won’t have such a magical profit/cost ratio in future, but the overall trend is still looking really good.

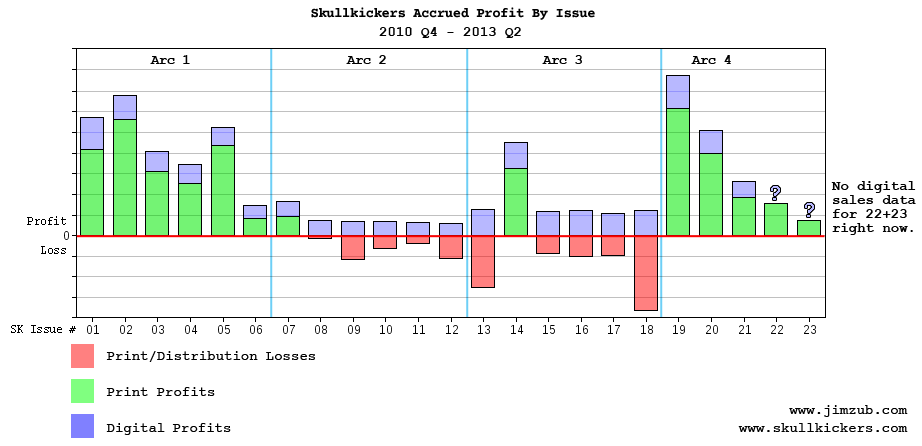

Last time I had a profit chart also broken down by issue. Some of the numbers I plugged in to that chart were incorrect, so I’ve put together a revised/updated one:

Keep in mind the above is profit, not sales.

The bad/good news is that some of the issues I thought were profitable actually went into the red, but there were others that performed better than I’d originally thought. What is consistent is that profits generated from digital have helped even out or exceed most of the losses incurred in print.

Issue #13 and 18 look worse here than they really are. We printed sketch variant covers for those two issues and I sell them direct at conventions, so they’re counted against our costs but aren’t reflected on the profit side.

Our fourth story arc was built around a ludicrous “reboot promotion” I came up with. We released five new #1’s in five months.

The Uncanny Skullkickers #1 (a.k.a. Skullkickers #19)

Savage Skullkickers #1 (a.k.a. Skullkickers #20)

The Mighty Skullkickers #1 (a.k.a. Skullkickers #21)

The All-New Secret Skullkickers #1 (a.k.a. Skullkickers #22)

Dark Skullkickers Dark #1 (a.k.a. Skullkickers #23)

It generated a lot of sales hype and put us back on the map for readers and retailers alike. We saw a big increase in digital sales and trade sales as well. There’s a good reason why publishers hit the ‘reboot’ button when sales are low. It can give readers and retailers a fresh jumping-on point to build sales from. We mocked the trend, but also benefited from it in a big way. I don’t think we could do it again, but it was a solid booster at the time.

I don’t have the full data for issues 22 and 23 just yet, so that drop off looks more severe than it really is. From all indications we’ve leveled out well and are poised to continue the series in a slightly profitable way instead of the rocky economics of arc 2 and 3.

You can really see the importance of digital sales here. On issues that have long been out of print the digital version keeps selling 24/7 without any additional printing or shipping cost. That build up of digital sales over 3 years has put issues like #8, 10, 11, 15, 16, and 17 into profitable territory even though the print versions lost some money.

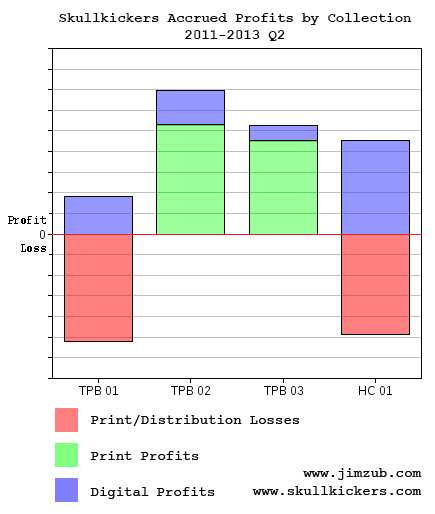

The growth in our collection sales, both in print and digital, looks very promising:

Skullkickers Vol. 1: 1000 Opas and a Dead Body is value-priced at $9.99 and has to stay in print otherwise people can’t get started on the series. Keeping this first volume in print at that price point is tough, but we use it as a loss leader to grow our overall readership. Over the long-long haul it pays off if people get on board and pick up other full price volumes. With 6 volumes planned we want the bar to entry as low as possible.

Profitability on volume 1 fluctuates a lot due to larger print runs and the wider push it gets as the entry point for the series. It’s still not profitable on its own merits, but it’s done a great job at bringing people on board the series and, with 6 volumes planned in total, as long as the other volumes sell well it will have done its job.

Skullkickers Vol. 2: Five Funerals and a Bucket of Blood is now quite profitable and continues to chug along. I’m hopeful that all our trade paperbacks will move into healthy territory like this.

Skullkickers Vol. 3: Six Shooter on the Seven Seas did well, as I theorized it would in my previous post. Given that it came out 10 months after Volume 2 it’s seen a big spike in orders, which is exciting. We recently ran out of stock and had to order a second printing, which also bodes well (but will incur added printing costs on the next accrual).

Skullkickers Vol. 4: Eighty Eyes on an Evil Island came out in July 2013, so it’s not shown on this chart. I’ll see that in the 2013 Q3-Q4 accrual. Fingers crossed.

Skullkickers Treasure Trove Vol. 1, our 1+2 combined deluxe hardback, is an expensive book to produce. It hasn’t sold like crazy through comic shops but over the long haul it seems to be working out because of the high cover price. It’s also a sales dynamo for me at conventions so I want to keep it in print and keep selling it directly to fans.

I was shocked at how much Treasure Trove digital sales have jumped over six months. The digital profits have surged, almost evening out the cost of producing and distributing the expensive deluxe volume. I wasn’t expecting that at all. Between that and the healthy direct sales I get at conventions, I’m thrilled to have Treasure Trove available.

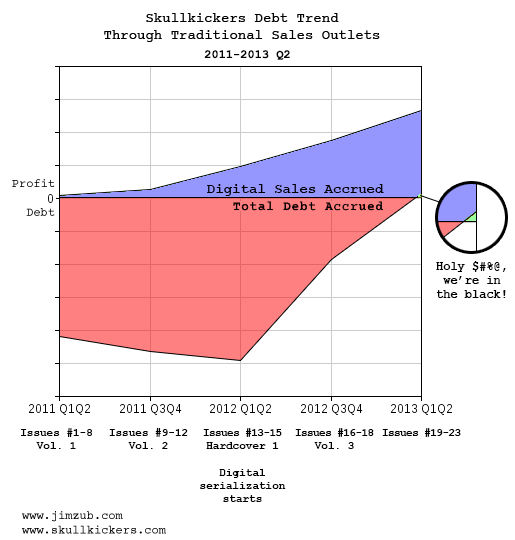

I theorized that by the end of our 6 volume series (late 2014/early 2015) we had the potential to be ‘in the black’. How’s that prediction looking?

I was wrong.

We’re doing way better than I expected and in the first half of 2013 we hit profitability!

It’s not a tidal wave accrual payment by any means, but it is a huge confidence booster that gives us financial momentum to carry through to the end of the series. I can’t tell you how surprised I was when I opened up the new statement and saw that we were (by my original estimation) over a year ahead of where I thought we’d be.

Image has stuck with us. They believed in our quality and long term potential, letting us ride out the lows of 2011-2012, until we could build a healthy backlist of material to leverage over the long haul. They were able to make their base amount and keep us rolling. Most other publishers would have cancelled the series after that initial drop off.

Keep in mind this is just analysis of one creator-owned series. As interesting as it can be, I can’t speak to anyone else’s sales or their financial situation. I don’t think this sales cycle corresponds to all creator-owned books. Please don’t assume every money-losing comic will bounce back over the long term and don’t make your own financial decisions based on what I’ve done. Everyone’s risk threshold and situation is different. You may end up throwing good money after bad. My next creator-owned project will have a completely different sales cycle.

Note that this is not the full financial picture. The above charts don’t include convention sales, which have more than doubled from 2011-2013. The money made from direct convention sales, sketch covers, commissions and selling original page art has helped keep us going and viable. I exhibited at 10 conventions this year and, even though it was exhausting, it really paid off in terms of sales and visibility for the series. It also doesn’t include money made from web ad revenue generated at our webcomic site, or money from licensing Skullkickers to the Munchkin card game series.

Also note that none of the above takes into account freelance work that’s come from working on Skullkickers. If you factor in money made from the writing jobs I’ve done for UDON, Bandai-Namco, Valiant, Dynamite, IDW and DC Comics since the series began, it has turned a substantial profit in that way even after paying the art team out of my own pocket. Skullkickers has been the foundation where I’ve built a 2nd career as a professional comic writer over a relatively short period of time.

Most importantly, we put out a comic that stands favourably beside some of the best titles in the industry and I’m incredibly proud of that. It represents the professional quality and work ethic of our creative team.

If you find my tutorial blogposts helpful, feel free to let me know here (or on Twitter), share them with your friends and consider buying some of my comics to show your support.

Zub on Amazon

Zub on Amazon Zub on Instagram

Zub on Instagram Zub on Twitter

Zub on Twitter

I love digging into this stuff – and the digital performance is awesome to see (and also the reason why I’ve been pushing both for a backlist title of mine as a webcomic, AND each of my current pitches suggests it as an additional format to expand our potential reach).

Out of curiosity, is that a combination of digital sales outlets, or is that strictly Comixology? And if it’s a combination, do you see one service greatly outpacing another?

The digital sales is a combination of comiXology, IVerse, and Graphically. ComiXology is over 90% of the digital sales happening on our series at this point.

Yeah, that’s been our experience, too, as far as the digital splits go. comiXology really has the market cornered so far – I’ll be interested to see, once numbers come in around the DRM-free Image offerings, if a reader service pops up to support that kind of in-app purchase…

Thanks for the info!

Hey, this all really interesting. I love seeing the back end of this business. I’m an independent comic creator just starting out and running my first Kickstarter (http://kck.st/18hmD7H) right now, so seeing a peek at people making a go this and returning a profit is very cool! Thanks.

Best of luck with your comic project.

Thanks, Jim!

Wow, so much information, thank you for putting this out there! I think it’s really valuable for anyyone in digital comics publishing. In the overall debt accrual chart, it says ‘traditional sales outlets’. Is this chart for everything excluding cons? Sorry if I’m asking for something too specific.

Glad you found it useful.

I cover this at the bottom of the article. It doesn’t include conventions, web ad revenue, or licensing money.

Congrats on reaching profit. My comics are still in the red, but gaining fans. You’ve actually given me hope to stick with it and see if i can get closer to actually making some money off my endeavours.

Everyone’s path is different (just as everyone’s comic is different) so I’m happy to be helpful, but don’t assume things will take a similar path, good or bad. Wishing you all the best with your creative pursuits.

Zub,

This is some great info. Thanks for sharing.

Meeting you at TCAF last year was really fun, and I didnt get to geek out about how WTF #13 was then. Still really love the series and the happy to see it’s now starting to pay off for you.

Have you seen many sales through the Image.com DRM free site?

Did you ever come to a conclusion about the pirated Russian language translations?

Hope to see you at a Detroit Area con one of these days.

-Neil Cameron

Image’s DRM-free site started in July so there’s no data on that until Q3-Q4 is tabulated.

Legally, I can’t formally endorse an illegal translation or give them access to my original page files. Mind you, I also have no way of stopping them.

If a Detroit convention wanted to bring me out as a guest I’d certainly consider it.

Hey Jim,

Thanks for the info. I find these kinds of analyses infinitely interesting. I have a question, though.

This is intended with absolutely no snark, but how do you price the digital collections? I just took a quick look at comixology and it was a little scattered with the second treasure trove having significantly less pages, but being more expensive. I assume because it is more recent? Is there a set schedule when the prices are reduced?

Just curious.